Money has vital applications in every transaction, be it a business or for an individual. We all use money to meet all the daily transactions from paying for the basic necessities to pay tax to the government. Since last decade, digital currency, most importantly cryptocurrency has been very protruding. The individual investors are interested in virtual currency investment along with the real financial investment. Hence, understanding the basics of tokenomics will benefit lot of cryptocurrency investors to know the real value.

B.F. Skinner, in the year 1972 was the first person who gave the idea of token economy and over the years it gained lot of focus in economic institutions and associated policies for creation of tokenized goods and services. The word “Tokenomics” is a combination of two words: “Token and Economics”, it is also called “Crypto economics”. It is basically a study of the crypto token economics which changed the perception of financial systems. Although cryptocurrency created a lot of promising economic opportunities, they lack tangibility, like any other real currency – you cannot touch and feel the virtual currency. Hence, the Crypto tokens are units of value of the blockchain which builds on the existing blockchains network which can be hold and exchanged. By knowing the values investors can invest in tokens. Tokens are valuable assets like any other real currency could serve all the functions in the blockchain networks other than serving only for trading assets.

There are two types of tokens namely, layer 1 and layer 2. Layer 1, known as security tokens are used for investment, purchase etc and represent specific blockchain whereas, layer 2, known as utility tokens help decentralized applications in a network. Understanding the concept of Crypto’s tokenomics is very important for the investor at the time of making decision on investment and provides incentives to the token holders.

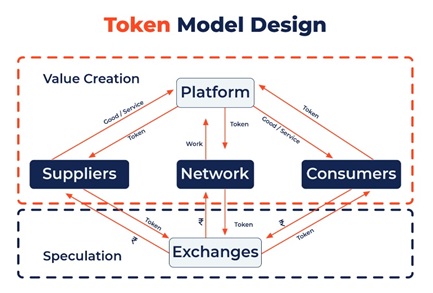

The most critical aspect of tokenomics is the governance. Each core team working for the project is held responsible for framing the rules to create and mint the tokens and also emphasizes on the approaches to inject the tokens into the blockchain network and taking out of it. Corporates can also use the tokenomics in their corporate governance models for allocating voting and decision making. For creating the reliable token model, it is very important to include industry experts, programmers, economists and expert mathematicians in the team.

To conclude, it is clear that tokenomics is slowly emerging as new asset class with the potential to transform the global financial system. The growing interest in blockchain and cryptocurrency certainly create lot of opportunities in tokenomics.

Prof. Ramya H P,

Assistant Professor,

DSCE – MBA